As Congress prepared to wrap up work on a budget deal that resolved the Republicans’ debt ceiling crisis, Senate Majority Leader Chuck Schumer declared last night, “America can breathe a sigh of relief — because in this process, we are avoiding default.” As NBC News reported, he and his colleagues voted soon after to pass the Fiscal Responsibility Act.

The Senate voted Thursday night to pass a bill that would extend the debt ceiling for two years and establish a two-year budget agreement on a broad bipartisan vote. The vote was 63-36.

Despite the fact that the measure was endorsed by Senate Minority Leader Mitch McConnell, only 17 of the chamber’s 49 Senate Republicans — roughly one-third — voted for the bipartisan compromise. In contrast, nearly two-thirds of the House GOP conference helped approve the same bill a day earlier.

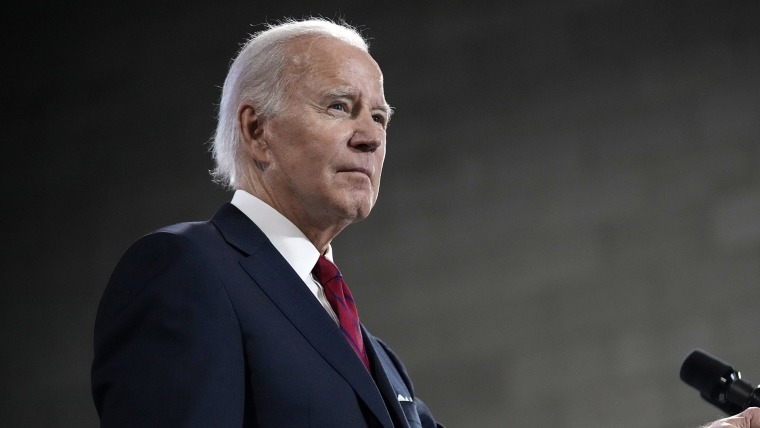

The agreement now heads to the White House for President Joe Biden’s signature, with just a few days to spare ahead of the default deadline.

At this point, it’s easy to imagine some observers concluding that this process really wasn’t that bad after all. Sure there was a hostage standoff, the argument goes, but the powers that be worked out a compromise; leaders in both parties and both chambers endorsed it; and the deal cleared Capitol Hill with relative ease ahead of the X-date.

Perhaps, these observers will say, the debt ceiling policy isn’t that scary after all. Everyone has an interest in making sure the default bomb doesn’t go off, so the public — here and around the world — can take some comfort in the apparent fact that officials won’t actually allow it to detonate. The status quo is fine, the argument goes. All’s well that ends well. The talk about reforming the system is overwrought.

Those making this argument are mistaken.

This process was ridiculous, and by any fair measure, indefensible. Congressional Republicans could’ve pursued these same goals through the normal, traditional budgetary process, but they instead thought they’d have greater success if they threatened to impose an economic catastrophe on purpose.

Global economic superpowers can’t expect to maintain respect and credibility while careening from one self-imposed crisis to the next, all while one of the nation’s major political parties sees extortion as a worthwhile substitute to their own country’s system of legislating.

What’s more, the results weren’t harmless. As The Washington Post’s Catherine Rampell explained in a column earlier this week, “China and Russia have benefited from our obvious fiscal dysfunction, portraying the United States as an unstable democracy and unreliable economic partner. Discussions at the Group of Seven meetings were hijacked by concerns over the global fallout of a possible U.S. default. Biden had to cut short his diplomatic trip to Asia so he could prevent Republicans from throwing a temper tantrum, further undermining U.S. efforts to repair relations with our allies.”

Rampell added, “There also might be longer-term reputational and financial costs thanks to this episode, particularly if we’ve now set ourselves up for another hostage crisis two years hence.” On this point, we don’t even need to speculate: Foreign officials have already said, out loud and on the record, that this fiasco has led them to reassess their perspectives on the stability of United States, and not in a good way.

The Peterson Institute for International Economics’ Marcus Noland told The New York Times a couple of weeks ago, “If you are a central banker, and you’re watching this — and this is a kind of recurring drama — you may say that ‘we love our dollars, but maybe it’s time to start holding more euros.’ The way I would describe that ‘Perils of Pauline,’ short-of-default scenario is that it just gives an extra push to that process.”

Indonesian Finance Minister Sri Mulyani Indrawati, meanwhile, told The Wall Street Journal, “The world is starting to question whether this is only just a game of repetition that can be solved, or the world’s to start to learn to wean ourselves from that kind of situation at the end of the day. That’s not good for the United States.”

Yes, obviously it’s a relief that the crisis has been averted. But when dealing with actual explosives, no sane person would ever say, “The bomb didn’t go off, so there’s no harm in just leaving it lying around.”

The same is true with the debt ceiling.

As Biden prepares to sign his name to the deal he helped negotiate, the dust settles on the process, and everyone collectively exhales, it’s tempting to start shifting attention elsewhere, leaving the ugliness behind. But this is actually the perfect time for a renewed conversation about how incredibly dangerous the debt ceiling is and why it needs to be eliminated — sooner rather than later.