House Democrats have included a minimum wage of $15 an hour, phased in over the next five years, in the latest Covid-19 stimulus bill. At the moment, it's not clear whether the proposal, which President Joe Biden supports, will make it into law. But what is clear is that it would bring nearly a million people out of poverty.

Nearly 8 percent of the working population works more than one job to support themselves and their families.

It would simultaneously reduce levels of employment, but the reduction in jobs wouldn't necessarily be a bad thing. Somewhere between 5 million and 10 million low-wage-earning people in the U.S. — nearly 8 percent of the working population — work more than one job to support themselves and their families. A substantial increase in the minimum wage would mean many of those workers could forgo their secondary jobs.

I've heard the argument that suffering small businesses can't absorb a wage increase in a recession caused by pandemic-induced shutdowns. This argument has validity, but the wage issue needs to be solved somehow, and a country as wealthy as the U.S. needs to pay its workers appropriately.

For most people, where you stand on the minimum wage depends on how you think fair wages should be determined. To answer that, you have to grapple with a series of questions, questions that our country has put off dealing with for decades.

At the top of the list: What's a "fair" wage? The simplest answer is frustrating: It depends on what you think "fair" means.

For a small-business owner, like the many I've spent months speaking to as I travel across the country, a fair wage may be the lowest wage you can pay someone with the appropriate qualifications to work for you. You might want to pay them more, but the economics of your small business might not allow for it. Paying higher wages would drive your costs up, which could hurt your bottom line if you try to pass those costs on to your clients. If wages go up but your income doesn't, you could be forced to cut staff.

If you're an economist, your priority might be to make sure wages keep pace with the cost of living, allowing workers to consume at least as much as they have been able to in the past, keeping the economy from shrinking. Without other sources of income, the only way a worker in a growing economy can maintain a standard of living is to have regular, periodic wage increases.

If you're a worker whose income derives from your labor (instead of from investments or an inheritance), a fair wage is your entry point into the greater economy. Unless you own property or stocks, you often have no other way to create wealth. If one minimum wage-paying job doesn't cover your expenses, you might need another. If your wages were to increase, you might be in a position to give up your extra job.

What's a "fair" wage? The simplest answer is frustrating: It depends on what you think "fair" means.

So do workers deserve a higher minimum wage because the economy — as measured by growth in gross domestic product, corporate profitability and increases in prices of assets like houses and stocks — is, generally, prosperous? If the answer is yes, the "fair" in fair wage is about equity — that workers should properly share in society's wealth.

Or do workers deserve a higher minimum wage because they can't cover the basic costs of living without it? For those who agree with this statement, "fair" is a matter of economic justice.

Or do workers actually deserve nothing, since work, and the wages paid for it, are entirely transactional? Under this paradigm, no one, at any wage level, would be paid a cent more or less than the market dictates.

Advocates of option three believe workers are free to sell their labor to the highest bidders for the amount that bidders will pay. Accordingly, no employer will be able to fill empty positions if it pays less than the market will bear. If there is a surplus of workers, as there is now, wages should fall, in their view. Conversely, when there is a shortage of workers, as there is likely to be as shutdowns end, wages overall will increase. That alone should dictate wage levels, no "fair" about it. Proponents of this would also be likely to argue that the government doesn't pay the wages, so it shouldn't have any say in deciding what private employers pay their workers.

When the federal minimum wage was established in 1938, it was 25 cents an hour, equivalent to about $5 an hour in today's dollars.

All this brings us back to the Democrats' proposal. While $15 is the offer on the table, the federal minimum wage — a floor for what normal hourly workers must earn with few exceptions — currently stands at $7.25 an hour. Assuming 40 hours of work per week, that equates to $15,080 a year.

But most states also set their own minimum wages. Fourteen states match the federal rate, and Virginia's will increase on May 1. Twenty-eight states have higher minimum wages than the federal standard. Two states — Georgia and Wyoming — have minimum wages of $5.15 an hour on the books, but they are still required by the Fair Labor Standards Act to ensure that employers adhere to the federal minimum, as are Alabama, Louisiana, Mississippi, South Carolina and Tennessee, all which have no state-mandated minimum wages. Washington, D.C., mandates a minimum hourly wage of $15. Some other high-cost-of-living cities have minimums higher than their states'.

Most minimum wage earners do end up making more than $7.25 an hour, and many major corporations have increased their own minimums both to attract workers and to repel protests. Costco has become the latest, announcing on Feb. 25 at a Senate Budget Committee hearing that it would increase its base wage to $16 an hour.

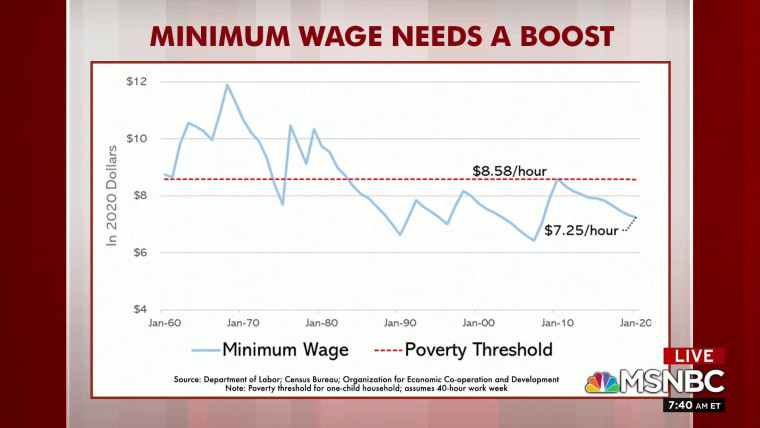

When the federal minimum wage was established in 1938, it was 25 cents an hour, equivalent to about $5 an hour in today's dollars. For the next 30 years or so, it was adjusted regularly to keep pace with inflation, hitting its peak of relative purchasing power in 1968. If the minimum wage had kept pace with inflation since then, it would be about $11.76, which is why, until the emergence of the "Fight for 15" movement in 2012, labor activists had been calling for a minimum wage of about $12.50 an hour.

But proponents of an increased minimum wage make another compelling point: Accounting for inflation doesn't track with how much more productive workers are today than they were back in 1968. According to a January 2020 study by the Center for Economic and Policy Research, given how much more output a single worker now generates, the minimum wage should be about $24 an hour.

Wages are the starkest manifestation of economic inequality — which the U.S. suffers from in greater measure than its counterparts

What it boils down to for me is that the pandemic has illustrated the degree to which our society and our economy runs on low-wage hourly workers. These workers are also the least able to weather the resulting economic downturn, in part because of their lack of accumulated savings, health insurance, job security and alternative employment options. While the wealthy can capitalize on low interest rates to acquire assets, the working poor cannot. Minimum wage earners generally have the weakest employment protections and are less likely to be unionized.

In America, those in the working class can't even make ends meet; increasingly, they stand virtually no chance of getting ahead or leaving any material wealth behind for their children.

Raising the federal minimum wage would have concurrently positive and negative effects. But using the examples of other industrialized countries, I believe it would result in an increase in prosperity (especially if it were paired with increased health coverage, though that doesn't seem within reach at the moment).

Wages are the starkest manifestation of economic inequality — which the U.S. suffers from in greater measure than its counterparts. It's good economics and politics for the richest country in the world to have a fair, livable minimum wage. But it's more than that — it's a matter of principle that even the economically weakest can live their daily lives in dignity and get a fighting chance to participate in America's prosperity.