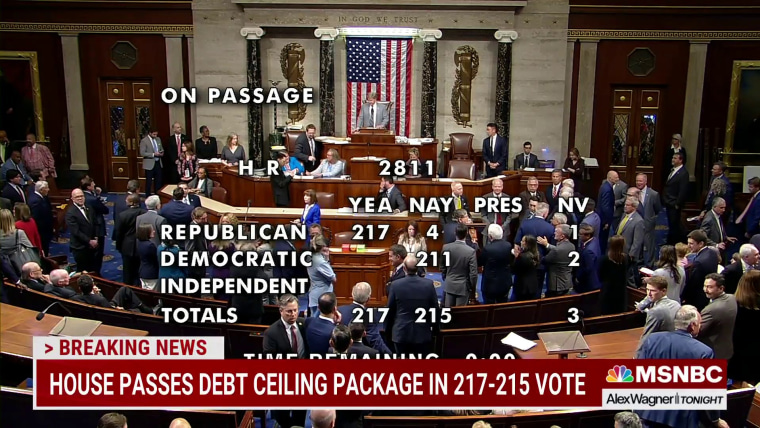

Before House Republicans narrowly passed a bill Wednesday that would include raising the debt ceiling in exchange for a new round of shredding America’s social safety net, House Majority Leader Steve Scalise, R-La., offered up a folksy summation of the issue: President Joe Biden, he said, has “maxed out the nation’s credit card.”

Though I’ve used similar language with a different framing, it’s not the best analogy. The better comparison to our debt ceiling situation would be a bank providing a credit card with literally no limit, but the credit card holder insisting that there be a limit — and pitching a fit when that limit approaches.

The difference between those two illustrations matters because Republicans know well that the debt ceiling itself is arbitrary. It’s not a stretch to say the amount of debt that the U.S. can take on is entirely made up. Any increase to the debt ceiling itself — currently set at $31.4 trillion — has historically been based on nothing more than what will suffice politically until the next time it needs to be raised. Tucked inside a CNN article on how House Speaker Kevin McCarthy, R-Calif., pulled off Wednesday’s vote was this eye-opener:

In a private meeting in the Capitol, GOP leaders debated how high of a debt limit increase they should seek. Some had floated odd numbers because it sounded more intentional than an even number. One member suggested $1.69 trillion, but that was rejected because of the innuendos associated with such a figure, according to three GOP sources. Ultimately, a $1.5 trillion increase was the number they settled on.

CNN

For the record, the $1.5 trillion amount they landed on is expected to carry the country through less than a year, at which point Republicans would be holding us hostage again — and in the middle of a presidential election season. I’m no economist, and I can’t predict how much longer it would take to reach a debt ceiling $190,000,000,000 higher. But the House GOP leadership understands that, despite its dire public warnings of what a clean increase would mean, the way the number sounds matters more than the number itself.

Ideally, Congress would simply abolish the debt ceiling as easily as it created it in 1939. Since then, Congress “has acted 78 separate times to permanently raise, temporarily extend, or revise the definition of the debt limit,” according to the Treasury Department. And the limit hasn’t exactly been a driver of fiscal responsibility in the intervening years. As I’ve pointed out numerous times, Republicans and Democrats alike summarily ignored the spending caps put into place during the 2011 debt ceiling fight when they became inconvenient.

The House GOP leadership understands that, despite its dire public warnings of what a clean increase would mean, the way the number sounds matters more than the number itself.

Instead, the GOP seems to be pursuing one of two strategies these days, neither of them sensible. The first, which has somehow become the establishment position over the last decade, is that the Democrats will blink in the GOP’s game of fiscal chicken. No, these antics won’t balance the budget or anything but if this current hostage-taking works, it will set a precedent for further spending cuts next year once the ceiling is hit again. This is a gamble, to say the least, given that there’s little chance that Republicans stay united should the contents of Wednesday’s bill be changed during negotiations.

The other conservative position, which former Trump official Russ Vought has been pushing on Capitol Hill, is even more bonkers. It argues that if the debt ceiling is breached, then it’s not a problem because nothing really bad will happen as a result. And besides, say the economists advocating for Republicans to hold firm, the effect of more debt and spending will be significantly worse than the U.S. not making honoring its debts. That stance also assumes that the most important payments will be prioritized, despite officials saying that it’d be almost impossible to sort through all the payments that the government makes each day. It also assumes that the global economy wouldn’t nosedive at the sight of America struggling to pay its debtors.

Neither the group counting on Democrats to cave or the group arguing that the U.S. defaulting wouldn’t be so bad is willing to accept that the debt ceiling is a terrible point of leverage. It has to be raised regardless of what conditions the GOP sets. The second-best thing for Republicans to do here would be to offer up a clean debt limit raise as Biden and Democrats have insisted and then have an honest conversation about next year’s spending limits. The absolute best thing Republicans could do would be to admit that the debt ceiling has outlived any possible usefulness and support getting rid of it once and for all.

But instead, Republicans are betting that their defense of a fake number in the name of cutting benefits to millions of Americans is a real winner.