Here’s another scandal that Donald Trump doesn’t want you to know about, and it doesn’t involve Adolf Hitler, Jeffrey Epstein or Jan. 6. No, this one involves you — specifically, your retirement.

More than 67 million Americans collect Social Security benefits, including roughly 54 million retired workers. Millions more expect — or at least hope — the program will be there when they grow old. Most retirees depend heavily on Social Security for their income; between 10 million and 16 million older Americans would be in poverty without it, according to the Center on Budget and Policy Priorities. The program disproportionately helps lower-income Americans, women and people of color.

And here’s the scandal: If implemented, Trump’s economic proposals could bankrupt this vital, popular program within six years.

Every one of Trump’s favorite ideas in this campaign would accelerate Social Security’s time to insolvency.

First, a brief explainer: Social Security funds its benefits with payroll taxes on working-age Americans. After a bipartisan funding deal in 1983, the program ran a surplus every year for nearly three decades, building up its trust fund for the retirement of the baby boomers. But in 2021, Social Security started to run a deficit. The Congressional Budget Office projects that the trust fund will run out before 2035. At that point, benefits will immediately shrink by more than 20%, around $400 per month per recipient on average.

This impending crisis, fortunately, is solvable. Vice President Kamala Harris has proposed raising revenue by increasing taxes on Americans who make over $400,000 annually. Sen. Bernie Sanders’ Social Security Expansion Act — which Harris co-sponsored as a senator — would go even further: Income over $250,000, as well as business and investment income, would become subject to the payroll tax (currently, payroll tax income is capped at $168,000, so even, say, Jeff Bezos pays no taxes on his income beyond that). These adjustments would make the program solvent for decades, benefits would increase by $200 a month and just 7% of Americans would see their taxes go up. And unlike many tax increases, this one is popular with voters.

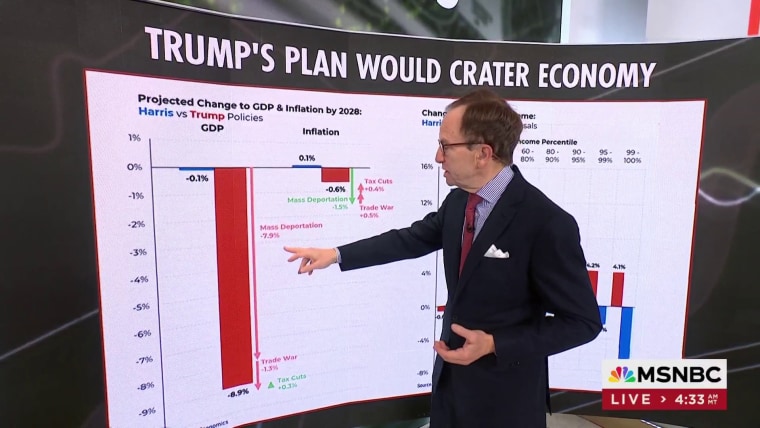

Trump has not explained how he would keep Social Security solvent. Worse yet, according to a new analysis from the Committee for a Responsible Federal Budget, every one of Trump’s favorite ideas in this campaign would accelerate Social Security’s time to insolvency and increase the resulting cuts to benefits.

Any list of Trump’s preferred proposals would include: mass deportations of immigrants; large tariffs on all imports; and eliminating taxes on tips, overtime pay and Social Security benefits. Some of these ideas are quite popular; Harris has even come out for “no tax on tips.” But taken together, these ideas could be disastrous for Social Security’s future.

Ending taxes on benefits, overtime pay and tips would shrink the program’s revenue streams. The massive tariffs would increase inflation — and therefore the program’s cost-of-living adjustments. Mass deportation of immigrants would remove millions of immigrant wage earners who contribute to Social Security (yes, even many undocumented immigrants pay payroll taxes). The Committee for a Responsible Federal Budget reports that in combination, these proposals would empty the Social Security trust fund by 2031, four years ahead of the current trajectory and just six years after Trump takes office. And what’s left for retirees would be smaller as well: benefits would shrink by one-third as soon as 2035.

Trump's third run has been the most plutocrat-friendly yet.

In Trump’s first campaign, he broke with other Republican candidates by promising to “do everything in my power not to touch Social Security.” But as I wrote earlier this year, “when it comes to Social Security … Republicans just can’t help themselves,” and Trump has been around a lot of Republicans for a long time now. When he was president, every one of his budgets proposed cutting Social Security. “There is a lot you can do in terms of entitlements, in terms of cutting,” he told CNBC in March. And now his platform is almost purpose-built to run Social Security into the ground.

But it makes sense that Trump would come around on torpedoing a program whose benefits are most important to the poorest Americans. Trump’s “man of the people” image has always been as fake as his tan, and his third run has been the most plutocrat-friendly yet. His 2017 tax cuts, for example, gave windfalls to the wealthiest but saved some scraps for the less well-off. His new platform doesn’t even do that. An analysis by the Institute on Taxation and Economic Policy found that Trump’s new tariff and tax cut extensions would only benefit the richest 5% of households, those that make at least $360,000. The top 1% — effectively, the millionaire class — would get an annual tax cut of $36,000. The other 95% of the country would pay more in taxes.

I can’t tell voters whether to prioritize democracy, their freedoms or their pocketbooks. But for all three concerns, the candidate who presents the biggest threat is the same: Donald Trump.