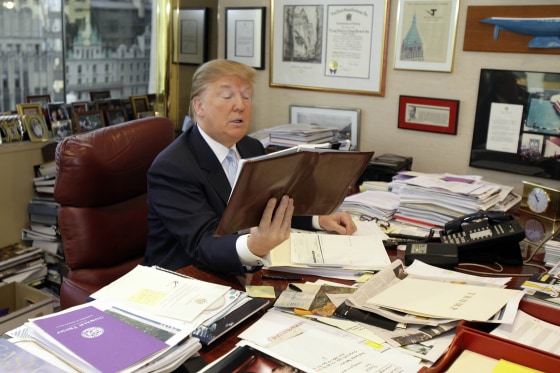

The wood-paneled boardroom featured at the end of episodes of “The Apprentice” helped refine the image of Donald Trump as a powerful businessman that launched his political career.

But in a wood-paneled courtroom over the last month, the sad reality behind that image has again been revealed.

Witnesses in Trump’s hush money trial in Manhattan have testified under oath that Trump cheated on his wife with a porn star and a Playboy model, sought to cover up those and other indiscretions by paying people off and then reimbursed his attorney for the sum of the payoffs by claiming they were legal payments.

Trump has denied all of this, and a jury will decide next week whether he is guilty of the charges.

But in giving this testimony, the witnesses also gave valuable insight into how shoddily the Trump Organization was run. In one telling exchange, defense lawyers even sought to highlight part of the mismanagement.

Trump’s former fixer Michael Cohen was on the stand describing his various efforts on Trump’s behalf. In an attempt to undermine Cohen’s credibility with the jury, Trump attorney Todd Blanche asked Cohen about an effort to rig online polls for Trump. Cohen said he’d initially agreed to pay a company called RedFinch Solutions $50,000, but later cut it to just $20,000. But when he went to be reimbursed, he asked for the entire $50,000.

In the end, he testified that he was paid more than double that amount because of a practice of “grossing up” — increasing the payment to cover the income tax.

Blanche asked if Cohen “stole from the Trump Organization,” and Cohen admitted without hesitation that he had. Trump’s allies sought to portray this as a damaging moment for the prosecution, and it certainly wasn’t helpful for Cohen’s credibility as a witness. Trump’s son Eric gloated about the admission on social media, saying the trial “just got interesting.”

But the younger Trump, an executive vice president of the Trump Organization, should be a little more interested in how Cohen got away with it.

Many Americans have been reimbursed by their boss at some point, whether for buying a cake for an office birthday party or for going out of town for a conference. If you have, you know the first rule: Save the receipt. Often, you have to scan it, upload it to some cumbersome software program, and fill in a bunch of fields to explain how you paid, what it was for, and why it was necessary for the business.

Cohen somehow got reimbursed for five times what he spent — for a total of $100,000. Again, to rig a couple of online polls.

It gets weirder.

In a 2019 Wall Street Journal article that first reported the payment, RedFinch Solutions owner John Gauger said he met Cohen at his office in Trump Tower to be paid and was handed “a blue Walmart bag containing between $12,000 and $13,000 in cash and, randomly, a boxing glove that Mr. Cohen said had been worn by a Brazilian mixed-martial arts fighter.” (Cohen denied that description at the time, saying Gauger was paid by check.)

The Wall Street Journal also reported that the repayment was made solely based on a handwritten note from Cohen. He did not, as it turns out, save the receipt.

This was just the latest account to undermine Trump’s long-vaunted business acumen. Earlier this year, a New York judge ordered Trump to pay $355 million in penalties plus interest (with a bond that was later reduced to $175 million) after finding that the Trump Organization had duped banks and insurers by overstating his wealth on financial statements. In a blistering 92-page opinion, the judge wrote, “The frauds here leap off the page.”

As a result of that case, Allen Weisselberg, the Trump Organization’s former chief financial officer, pleaded guilty to two counts of perjury after already serving 100 days in jail for avoiding taxes on $1.7 million in company perks. During the case, a court-appointed independent monitor also found that the company needed to change its procedures and update financial statements, noting that despite cooperating, the organization still regularly provided documents “lacking in completeness and timeliness.”

Much of this can be chalked up to the Trump Organization being a privately held conglomerate. Because they aren’t listed on stock exchanges, privately held companies don’t have to meet the strict disclosure requirements of the Securities and Exchange Commission. Still, few of the more than 25 million privately held companies in the U.S. are run in as slipshod a manner as these various stories have shown.

And that boardroom? The one shown on TV was a set, built by “The Apprentice” crew to be easier to film.

In a 2018 documentary, show producer Bill Pruitt said the real boardroom in Trump Tower was much less impressive. “If you walked around Trump’s actual office in Trump Tower you’d see the wood’s chipped, and what’s that smell?” he said in the film. “It wasn’t the empire we were going to have to sell to people. We needed to gussy it up a bit. And we did.”

Whatever else it accomplishes, the hush money trial has again pulled back the curtain to reveal the real boardroom, and it’s not a pretty sight.

CORRECTION (May 25, 2024, 1:56 p.m. ET): A previous version of this article misstated how much the Trump Organization owes in civil fraud penalties. It owes $355 million plus interest, not $175 million.