Three years ago, congressional Democrats and President Joe Biden approved a dramatic expansion of the child tax credit as part of their ambitious American Rescue Plan. It was a great success, which successfully reduced child poverty.

It was also temporary. The American Rescue Plan was designed to give the economy a short-term boost in the wake of the recession from Donald Trump’s final year in office, and the expanded child tax credit expired in 2022. (Democratic efforts to extend the policy faltered, in part due to opposition from Sen. Joe Manchin of West Virginia.)

As 2024 gets underway, however, a version of the policy is poised to make a welcome comeback. NBC News reported:

Senior lawmakers in Congress announced a bipartisan deal Tuesday to expand the child tax credit and provide a series of tax breaks for businesses. The $78 billion tax agreement between House Ways and Means Chair Jason Smith, R-Mo., and Senate Finance Chair Ron Wyden, D-Ore., caps months of negotiating and pursuing common ground in the divided Congress.

At this point, I imagine plenty of readers are wondering how in the world a conservative red-state Republican representative and a progressive blue-state Democratic senator reached a compromise on tax policy. The answer has everything to do with the motivations that brought the GOP to the negotiating table.

Just as much of the American Rescue Plan’s provisions were temporary, so too were elements of the Republican tax package that Trump signed in 2017. In particular, Republicans were desperate to rescue, among other things, deductions for research-and-development investments and expensing for investments in machines, equipment, and vehicles.

GOP officials were so eager to fight for these tax breaks for businesses that they were in a dealmaking mood, effectively asking Democrats, “What do you want in exchange?”

The answer was a renewed child tax credit. NBC News’ report added:

The new child tax credit policy would benefit about 16 million kids in low-income families, according to an analysis by the liberal-leaning Center on Budget and Policy Priorities. “The expansion would meaningfully reduce child poverty,” CBPP wrote. “In the first year, the expansion would lift as many as 400,000 children above the poverty line. 3 million more children would be made less poor as their incomes rise closer to the poverty line.”

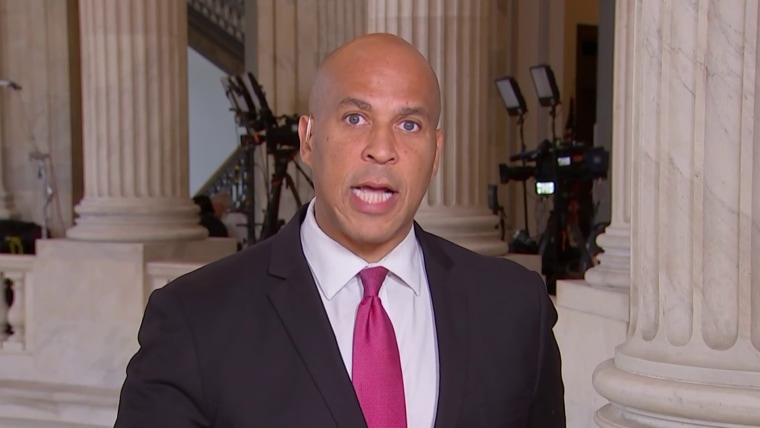

In a written statement, Wyden said, “Fifteen million kids from low-income families will be better off as a result of this plan, and given today’s miserable political climate, it’s a big deal to have this opportunity to pass pro-family policy that helps so many kids get ahead.”

This isn’t as ambitious or as generous as the original Democratic policy from 2021, but this is a plan that will help millions of families. What’s more, given the circumstances, it’s also a welcome development in a divided Congress in which bipartisan deals of any consequence seemed extremely unlikely.

As for paying for the package, Roll Call reported, “Tax writers plan to end the pandemic-era employee retention tax credit program early to cover the cost of the deal. They estimated ending the program would offset more than $70 billion of the package’s cost.”

Wyden’s plan is to pass this new agreement by the beginning of tax filing season, which is Jan. 29, which will be a heavy lift in a Congress that struggles to complete even routine tasks. Watch this space.